What Does Return Mobile ACH Payment Mean?

TABLE OF CONTENTS

Key Takeaways

- ACH Transaction Problems: Whenever an issue arises with a direct debit or credit card transaction processed through the Automated Clearing House (ACH) method, the involved parties send a code to identify the problem.

- Common ACH Return Codes: These are usually due to incorrectly entered information or insufficient funds. However, they can also reflect issues with authorization and more.

- Understanding ACH Returns: An ACH return occurs when the ACH fails to charge money from a customer’s account. The ACH return code reveals more about the problem’s source.

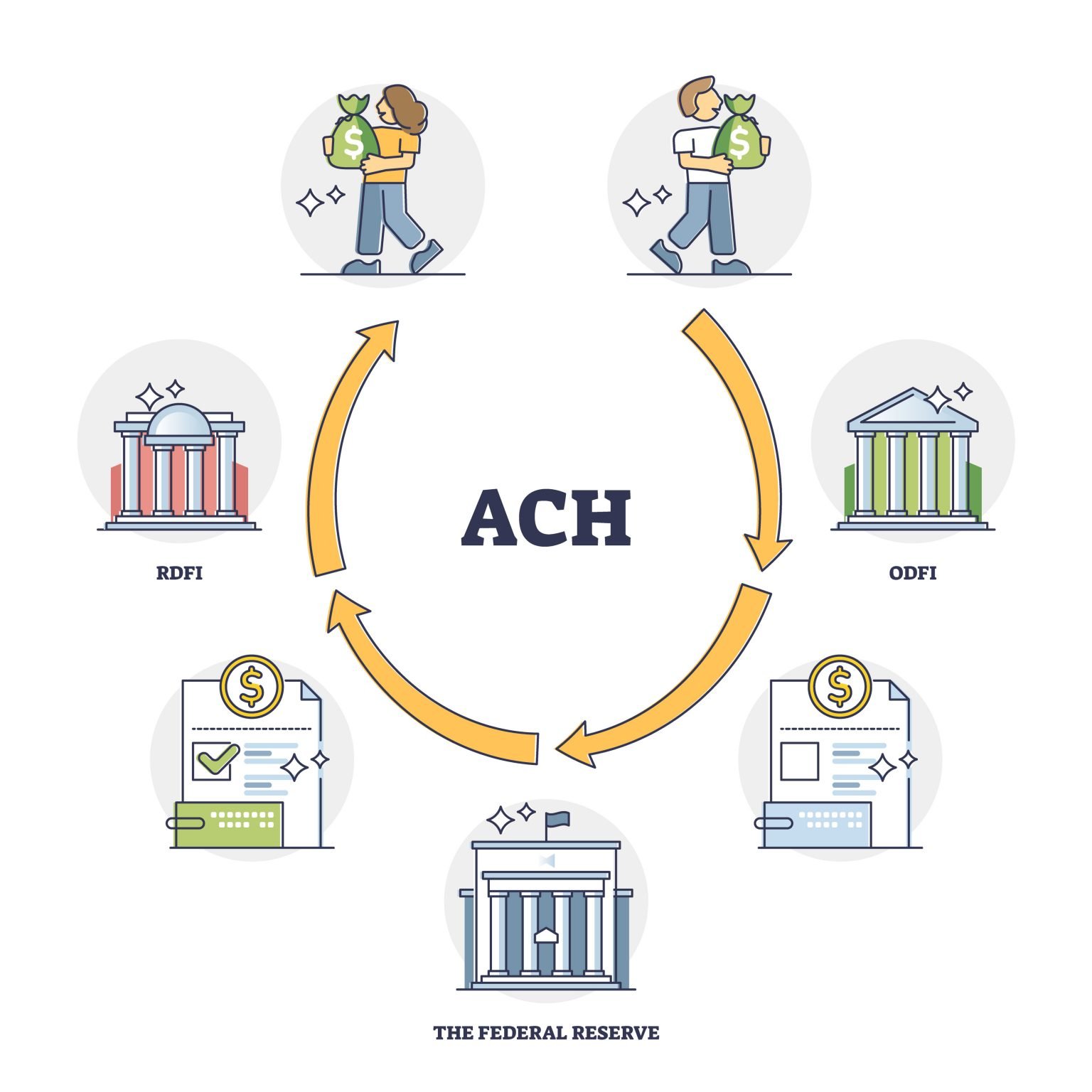

- ACH Payment Processing: Five parties are involved – Originator, Originating Depository Financial Institution (ODFI), ACH Operator, Receiving Depository Financial Institution (RDFI), and Receiver. If an issue occurs, usually the RDFI sends an ACH return message.

If you are using the Automated Clearing House (ACH) method to process customers’ transactions, you are likely to see three-digit codes if a problem arises.

Whenever there is an issue with a direct debit or credit card transaction, one of the parties involved in the payment processing will send a code. This code is your key to fixing or at least identifying what has blocked the transaction.

Some of the most common ACH return codes are caused by incorrectly entered information or insufficient funds available, while others can be more complicated and include issues with authorization and more.

Scroll down and search for the code you are looking for.

What Are ACH returns?

Automated Clearing House (ACH) payments are electronic payment processing carried out between two financial institutions (e.g., banks).

An ACH return means that the ACH failed to charge money from a customer’s account. When it happens, there is always an ACH return code that gives more information about the source of the problem.

There are two main ACH payment methods: direct deposits and direct payments:

- ACH direct deposits: Whenever you need to deposit your money to someone’s account, you can do it through ACH direct deposits. It is a kind of payment that goes from a commercial account holder to a consumer. Common ACH direct deposits include payrolls, benefits, tax refunds, or interest payments.

- ACH direct payments: These payments are electronically transferred from one bank account to another.

How Does an ACH Transaction Work?

To understand why ACH returns appear, you need to know how they work in the first place. There are five parties involved in making the payment processing go through:

- Originator

This is a person who submits an ACH transfer to the ODFI. - Originating Depository Financial Institution (ODFI)

The ODFI receives the request from the Originator and passes it to the ACH Operator. - ACH Operator

The ACH Operator links the two accounts by processing transactions (e.g., clearing, delivery, settlement). - Receiving Depository Financial Institution (RDFI)

The RDFI is the bank that is being charged or refunded. It receives the ACH entry and submits it to the Receiver. - Receiver

The receiver is the individual or company that allows the Originator to initiate an ACH entry.

If there is a problem with the payment processing, it is usually the RDFI that sends an ACH return message. In rare cases, you may have the ACH Operator or ODFI do that. It is always one of the parties involved that sends the error code, which is, in turn, provided by the National Automated Clearing House.

Why Do ACH Returns Happen?

ACH return occurs when the payment cannot be processed for any particular reason. The payment is rejected, and the code pops up, indicating the exact cause of the problem.

To understand the code, you need to have its definition. There are over 80 ACH return codes; we will look at the most common ones. Go ahead and search for the one you need or bookmark this page in case you see an ACH return code for the first time.

What Are ACH Return Codes?

There are ten most common ACH return codes that you are likely to see.

| Reason for return | ACH return code | Description | Time Frame | |

| Insufficient funds | R01 | The bank account you requested money from does not have sufficient funds | 2 banking days | |

| Account closed | R02 | The account you requested money from has been closed | 2 banking days | |

| No Account/Unable to locate account | R03 | The account number does not match the customer’s name/ The account does not exist | 2 banking days | |

| Invalid account number | R04 | There is an error in the account number (e.g., incorrect digits) | 2 banking days | |

| Unauthorized debit to consumer account using Corporate SEC code | R05 | The account number of a customer is a personal bank account, not a corporate one (in cases of B2B payments) | 60 calendar days | |

| Returned due to ODFI’s request | R06 | Authorization was failed (e.g., in cases of fraudulent payments) | Undefined | |

| Authorization revoked by customer | R07 | A customer who authorized the ACH payment has withdrawn it | 60 calendar days | |

| Payment stopped | R08 | A customer has issued a stop payment, which cancels a transaction | 2 banking days | |

| Unable to collect funds | R09 | A payment wasn’t completed because of lack of funds | 2 banking days | |

| Originator not known or not authorized to Debit Receiver’s Account | R10 | A transaction was incomplete or incorrectly submitted | 60 calendar days | |

Other ACH return codes are likely to occur, and they are:

| Reason for return | ACH return code | Description |

| Check truncation entry return | R11 | The debit entry stated the incorrect amount/The debit entry was debited before it was authorized |

| Branch sold to another DFI | R12 | The bank was sold to another Depository Financial Institution (DFI). The purchasing bank will continue to process entries submitted by accounts from the old branch |

| Invalid ACH routing number | R13 | An ACH transfer cannot be completed due to an incorrect routing number |

| Representative payee deceased or unable to continue in that capacity | R14 | The person to whom you have submitted an entry died |

| Beneficiary or account holder deceased | R15 | A bank account holder or a beneficiary did and cannot continue accepting payments |

| Account frozen/entry returned per OFAC instruction | R16 | The money cannot be collected because the account has been frozen due to a legal action against it |

| File record edit criteria | R17 | There is no valid account number or it was created under unclear circumstances |

| Improper effective entry date | R18 | The entry date that was added is invalid |

| Amount field error | R19 | The amount was entered incorrectly (e.g., non-numeric characters) |

| Non-transaction account | R20 | The account has been prohibited or limited |

| Invalid company identification | R21 | The company ID has not been accepted (e.g., it is invalid because of a typo) |

| Invalid individual ID number | R22 | A payment has been submitted incorrectly (e.g., a customer could enter incorrect information) |

| Credit entry refused by the receiver | R23 | The entry was refused because (1) the Receiver doesn’t recognize the Originator; (2) the amount wasn’t received; (3) the minimum amount required failed to be paid |

| Duplicate entry | R24 | The transaction matches another transaction submitted previously |

| Addenda error | R25 | There is a problem with the addenda record (e.g., types incorrectly, out of sequence, etc.) |

| Mandatory field error | R26 | The information hasn’t been entered into an obligatory field. The submission cannot proceed without this crucial piece of data |

| Trace number error | R27 | Trace number of an addenda doesn’t match the trace number of the entry detail record/the trace number is not present in the addenda record |

| Routing number check digit error | R28 | An ACH return has occurred because the routing number is entered incorrectly |

| Corporate customer advises not authorized | R29 | The Receiver has informed the RDFI that the originator is not authorized to process payments on their account |

| RDFI not a participant in check truncation program | R30 | The RDFI cannot process a payment without a physical check |

| Permissible Return Entry | R31 | The RDFI requests to return a CCD or CTX Entry |

| RDFI non-settlement | R32 | The RDFI failed to reach a settlement and couldn’t approve the transaction |

| Return of XCK entry | R33 | The RDFI decides to return an XCK Entry |

| Limited participation RDFI | R34 | The RDFI is denied or limited in participation |

| Return of improper debit history | R35 | The Return Entry was caused by an improperly submitted debit entry |

| Return of improper credit history | R36 | The Return Entry was caused by an improperly submitted credit entry |

| Source document presented for payment | R37 | The source document that was presented for payment relates to an ARC (Accounts Receivable Conversion), BOC (Back Office Conversion), and POP (Point-of-Purchase). |

Other Less Common ACH Status Codes

Here is a list of other less known and frequent ACH return codes. They only occur in specific situations, so you are unlikely to see many of them if not none.

| Reason for return | ACH return code | Description |

| Stop payment on source document | R38 | A stop payment has been issued on a source document |

| Improper source document or source document presented for payment | R39 | The RDFI considers the source document improper |

| Return of ENR entry by Federal Government Agency | R40 | The envelope with a credit entry has been returned |

| Invalid transaction code | R41 | The standards of the Enrollment (ENR) Entry weren’t met |

| Routing number or check digit error | R42 | The routing number or check digit is invalid |

| Invalid DFI account number | R43 | The DFI number, which is the recipient’s bank account number, is incorrect |

| Invalid individual ID number or identification number | R44 | The ID number provided is not correct or does not exist |

| Invalid individual name or company name | R45 | The individual name or company name entered is incorrect |

| Invalid representative payee indicator | R46 | The representative payee indicator code isn’t found in the government records |

| Duplicate enrollment | R47 | The identical ENR Entry was received from the same RDFI |

| State law affecting RCK acceptance | R50 | The RDFI is located in a state where the Uniform Commercial Code hasn’t been adopted or where you need to return cancelled checks back to consumers |

| Item related to RCK entry is ineligible or RCK entry is improper | R51 | An ACH payment is rejected by the National Automated Clearing House (NACHA) because it doesn’t meet the criteria |

| Stop payment on item related to RCK entry | R52 | A stop payment has been initiated on an item which related to the RCK Entry |

| Item and RCK entry presented for payment | R53 | The item that relates to the RCK Entry has been presented for payment |

| Misrouted return | R61 | The RDFI has presented an invalid routing number in the Receiving DFI Identification |

| Return of erroneous or reversing debt | R62 | An accidental credit entry was given to the Receiver is now being reversed |

| Field error(s) | R69 | One of the fields has not been entered with the correct information |

| Permissible Return Entry not accepted or return not requested by ODFI | R70 | The RDFI has identified the Return Entry and forwarded to the ODFI which hasn’t accepted it or is about to request it. |

| Misrouted dishonored return | R71 | The ODFI placed an incorrect routing number in the Receiving DFI Identification Field |

| Untimely dishonored return | R72 | The dishonored return has not been sent within the given timeframe |

| Timely original return | R73 | The original return has been sent within the given timeframe |

| Corrected return | R74 | The RDFI corrected a Return Entry that contained errors (R69) |

| Return not a duplicate | R75 | The entry that was previously sent by RDFI is not a Return Entry |

| No errors found | R76 | The original Return Entry did not have any errors that were identified by the ODFI in the dishonored Return Entry |

| Non-acceptance of R62 dishonored return | R77 | (1) The RDFI returned both the erroneous entry and the related reversing entry. (2) The R62 funds are not recoverable. |

International ACH Transactions

| Reason for return | ACH return code | Description |

| IAT entry coding errors | R80 | The IAT Entry is being returned because of (1) an invalid Foreign Exchange; (2) an invalid ISO Destination Currency Code; (3) an invalid ISO Originating Currency Code; (4) invalid Transaction Type Code |

| Non-participant in IAT program | R81 | The Originating Gateway is not in agreement with ODFI to process international entries |

| Invalid foreign receiving DFI identification | R82 | The reference that identifies Foreign Receiving DFI of an Outbound IAT Entry is invalid |

| Foreign receiving DFI unable to settle | R83 | There are settlement problems in the foreign payment system |

| Entry not processed by gateway | R84 | The IAT Entry cannot be processed by the gateway because it does not support transaction processing functions |

| Incorrectly coded outbound international payment | R85 | There is no information that is required to process a transaction |

Frequently Asked Questions

Can ACH payments be returned?

Yes, it is possible. There are many reasons that can cause the ACH payment to be returned. The most common ones are related to insufficient funds, incorrectly entered information or issues with an account.

Is It possible to dispute returned mobile ACH payment?

Yes, you can dispute returned ACH payment if:

- It was a duplicate

- It was misrouted

- It had incorrect information

- It did not occur within the designated timeframe

- It was caused by an accidental credit to the receiver that resulted from the reversal

How much is an ACH return fee?

ACH return fees may vary between $2 to $5 per return.

Final Word

The ACH return codes occur due to a problem related to your current transaction. It is never a case that the system crashes and asks you to reissue the payment. Always pay attention to the three-digit code you receive and search for the needed information here.