Net Present Value: How to Calculate and Use A Vital KPI

TABLE OF CONTENTS

If you spend time around investors or business people, you’ve likely heard the term Net Present Value, or NPV. You may find the term confusing if you’re new to business or haven’t needed to use KPIs (Key Performance Indicators).

Since NPV is an essential metric to gauge the health of businesses and investment options, understanding this tool is critical. In this article, we’ll do a detailed overview of this metric’s fundamental cornerstones, including:

- What is the net present value?

- How to calculate NPV

- Why the discount rate is important

- Positive NPV vs. negative NPV

- Limitations of net present value

- And more!

Let’s get into it.

What Is Net Present Value?

Net present value (NPV), also known as present worth (PW), is one of the most-used performance metrics in modern investment.

In the simplest terms, this metric indicates whether the overall outlay is more or less than the revenues earned by an investment. It also helps to narrow down the investment’s value at any time during the asset’s lifespan.

When you calculate NPV, it indicates what kind of return you can expect on your initial investment. It takes expected cash flows into account, both positive and negative, to determine the present value of your investment.

In short, it calculates the difference between cash inflows and cash outflows at the current time. The difference between these two cash flows indicates either a positive net present value or a negative one.

Any investment opportunity with a positive NPV is worth considering. Investing in projects with a negative NPV is less likely to yield profits.

Net Present Value NPV Use As a Profitability Index

Net present value doesn’t only work well as a no-frills profitability index. It also has several other uses, all of which provide value in some way.

You can use the NPV to calculate how much value an investment offers. It’s instrumental in investment planning when comparing multiple investments to find a suitable investment. The formula for this is:

- Profitability index = Net Present Value ÷ Investment Required

By comparing the profitability index for each project and choosing the one with the highest value, you can get the best returns on your investment.

Net Present Value NPV Limitations

As with any KPI or investment planning tool, net present value has limitations. Some of its most significant flaws include the following:

- It relies heavily on financial assumptions. The NPV calculation may be highly accurate or completely inaccurate depending on the accuracy of said predictions.

- It assumes that the discount rate will remain constant for the life of the invested cash. Realistically, the discount rate will vary significantly depending on other factors.

- It can be hard to calculate net present value in the case of investments with multiple years worth of cash flows. It can be incredibly complex because you’re also trying to account for future cash flows.

What Is the Discount Rate in NPV?

If you start working with NPV regularly, you’ll often hear the term discount rate. It’s a critical input when calculating net present value and typically refers to the minimum Rate of Return (ROR) for an investment or project.

However, there may be subtle variations since the company’s chief financial officer is generally responsible for setting a discount rate. It depends mainly on the benchmark the company is using to indicate success.

In short, the company uses the discount rate to adjust future cash flows, so they apply to the current economy.

Ways to Determine Discount Rate

At this point, it’s worth noting that all companies don’t use the same discount rate, nor do all industries. The average discount rates can vary by as much as 10% between sectors.

Which discount rate should you use when calculating NPV? There are several different ways to establish a discount rate, so let’s take a brief look at some of the most common:

- The firm’s weighted average cost of capital – The average rate investors expect a company to pay to its dependents. External factors are the main contributing influences rather than conditions within the company. However, any investment the company makes should contribute strongly towards the firm’s average cost of capital.

- The firm’s reinvestment rate – using the firm’s reinvestment rates can help to determine which investments are best. Since you already know the company’s average return on investment, you know the project in question must deliver at least that rate or higher profitability.

- Variable discount rates – when known, pre-established variable discount rates for the investment period are more likely to deliver accurate results. Instead of relying on a fixed number, they leverage predicted inflation rates and other values to help produce better results.

How To Calculate Net Present Value NPV

There are many ways to calculate net present value, some highly complicated and others exceptionally simple. We recommend keeping it simple because you’re less likely to tire of the process. Let’s take a look.

Net Present Value Formula

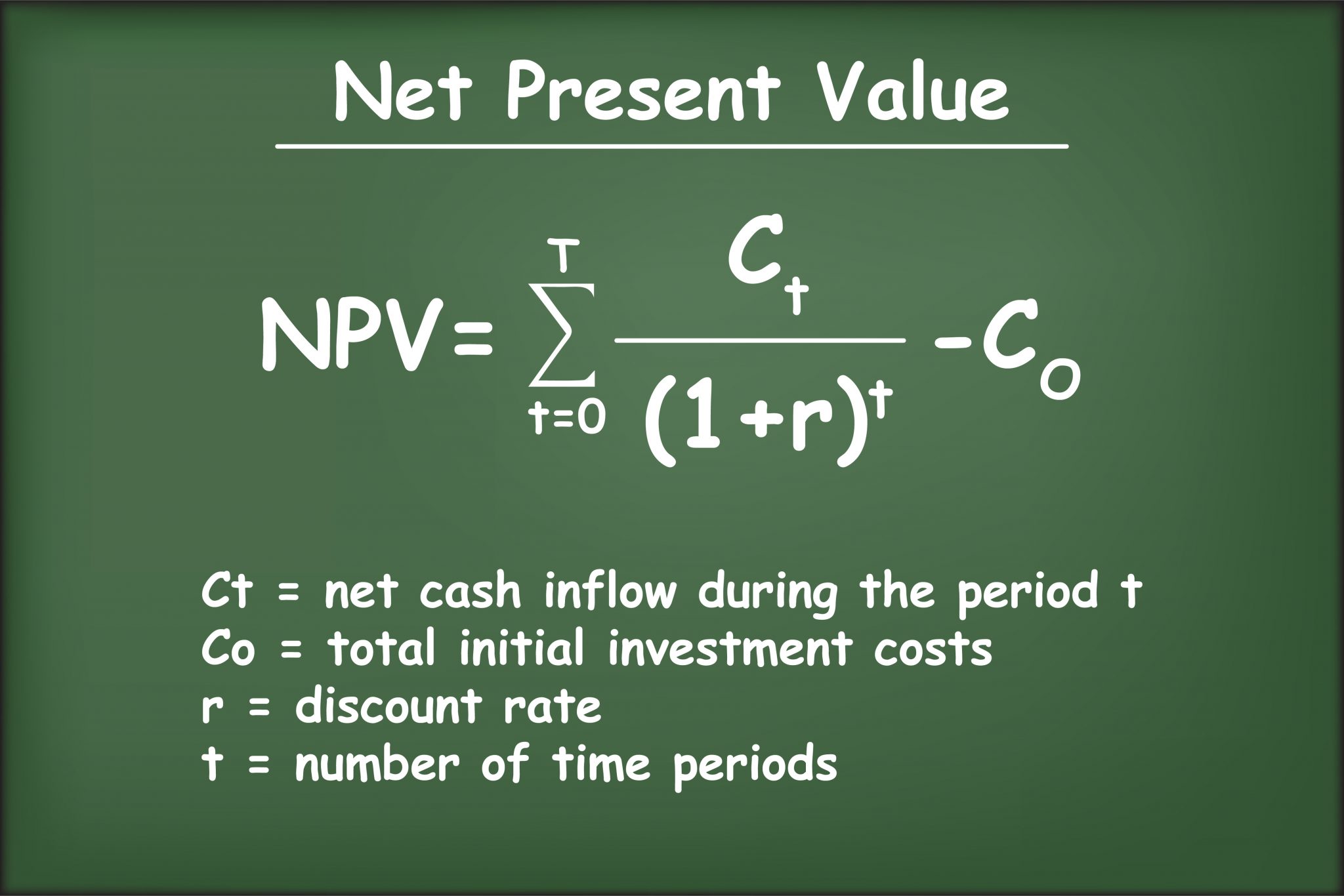

The formula for net present value can seem complex at first. To make things worse, similar formulae like that for present value can add to the confusion.

Once you understand the formula, it’s relatively simple, and you’re unlikely to have problems again. Let’s take a look:

Suppose the project you’re working on only has a single cash flow. In that case, the calculation will be considerably easier than for a project or investment with multiple cash flows occurring over a more extended period.

In its simplified form, the formula is:

- Net present value = expected cash flows (today’s value) – invested cash (today’s worth).

Formula for a Single Cash Flow Investment

You can represent a project with a single cash flow using the following formula:

- NPV = Cash flow ÷ (1 + required return) – initial investment value.

Another version of the same formula may read:

- NPV = Cash flow ÷ (1 + discount rate) – initial investment value.

Formula for an Investment with Multiple Cash flows

When the project you’re working with has multiple cash flows, the calculations become considerably more complex. The following formula represents their NPV:

- NPV = [Total annual cash flow ÷ (1 + discount rate)] x total number of years

While these equations and formulas all seem incredibly complex, it always comes down to the same basic idea:

- Net Present Value = Present Value – Present Cost

NPV Calculation Step by Step

Now that we’ve looked at the formula let’s consider the steps for applying it. It’s good to know how to calculate net present value manually in case you find yourself in a position where you need to.

Let’s go through it step by step.

Calculating the net present value for a single cash flow project

Financial formula, Net Present Value, NPV on green chalkboard vector

It’s best to start with a simple investment or project to get a feel for the basics before delving into anything more complex.

Let’s say you’re considering one of your real estate investment options that requires a buy-in of $50,000. Hence, your initial investment is $50,000.

The investment will produce an additional return (cash flow) of $25,000 at the end of eight months and return your initial outlay.

Since the average discount rate for the real estate industry is between 5% and 12%, we’ll assume a discount rate of 9%. Now let’s input that information into the formula listed above:

- NPV = [Cash flow ÷ (1 + discount rate)] – initial investment value.

- NPV = [$75,000 ÷ (1 + 0,09)] – $50,000

- NPV = [$75,000 ÷ 1,09] – $50,000

- NPV = $68,807.34 – $50,000

- NPV = $18,807.34

Calculate NPV Using Excel (or Another Spreadsheet Software)

Since net present value is such a popular KPI, many of the most popular spreadsheet software types have a built-in formula.

In Excel, the formula is simply =NPV. The complete equation for the Excel NPV calculation is NPV = (discount rate x future cash flows) + initial investment. When you use the =NPV formula, Excel allows you to choose the appropriate cell containing:

- The discount rate

- The sum of future cash flows

- The initial investment value

The convenient thing about this arrangement is that the spreadsheet automatically updates the end result if you change some of the contributing data.

The downside to this formula is that it gives you the PV, or present value, rather than the NPV, or Net Present Value. It also assumes that the periods used are equidistant.

To solve this problem, you can manually adjust by adding the 0-time value to the formula. Since the 0 value is always negative, adding it to the equation converts into a subtraction, giving you the actual NPV calculation.

Another option is to use the XNPV formula instead of the NPV formula. This formula allows you to assign specific dates to cash flow entries, so it uses all of them. It also doesn’t assume that the dates are equidistant. For both these reasons, it’s the more accurate formula.

Many other spreadsheets also have an NPV function, so always check your preferred application’s formula list.

Net Present Value NPV vs. Similar Metrics

Net present value is one of many useful financial tools in the wise investor’s arsenal. There are many similar metrics that you can use in different situations and to accomplish other purposes.

Below we’ll look at some of the most often used metrics and compare them to net present value, so you know what to use in which situation.

Internal Rate of Return

Internal rate of return is another popular financial metric allowing investors and businesses to keep track of their net worth.

As with net present value, the internal rate of return allows investors to see the potential of available investments. Unlike NPV, IRR and ROR aren’t generally used to calculate the current value of a given asset.

A financial advisor can use NPV at any time to determine the current value of investments already made.

Return on Investment

Along with NPV, most financial calculators stock the formula for ROI. Also known as return on investment, this is one of the most commonly used metrics in the economic sphere.

The main difference between the two types of metrics is their intended purpose. While net present value demonstrates the current value of a particular investment, return-on-investment calculator how much cash flow the company has gained as a whole.

Return on investment calculates the profit earned based on the value of the initial funds invested. Net present value demonstrates whether an investment is profitable based on current cash flow.

What Can Net Present Value NPV Show You?

Net present value NPV has several uses in the investment industry, mainly in terms of offering weighted totals. Because it considers inflation, NPV can show you a realistic value for future cash flow. Let’s look at one or two examples.

Projected Earnings Generated

Probably the number one use of the NPV formula is to predict the value of future earnings. Due to inflation, and other factors, the value of money doesn’t remain the same over time.

For instance, in the mid-1900s, $1 would have had much more spending power than today. NPV takes this into account, translating future cash flows into an understandable view of financial worth.

Probable Value of Future Cash Flows

NPV translates cash inflows into a weighted (or adjusted) figure using the same tools as projected earnings. Considering predicted inflation rates, and other relevant factors, the NPV equation helps you to see what each cash flow will be worth (approximately) compared to the current currency.

Net Present Value: Positive vs. Negative NPV

Now that you know how to calculate NPV, let’s look at how to tell whether the result is good or bad. It’s straightforward; if your NPV is a positive number, that’s a good result.

A positive NVP means that the future cash flow has more positive cash inflows than negative cash outflows.

A negative NVP means the discounted cash flow exceeds the positive cash flow.

In layperson’s terms, a positive NPV means that the expenses are less than the returns, so you can feel free to make that investment.

Remember that the closer a positive net present value is to zero NPV, the lower your profit margin is likely to be.

Final Thoughts: Net Present Value NPV Is a Valuable Tool

Net present value is a terrific tool that can help simplify the investment planning process. It can help you determine whether a particular investment is worth making. It can also help you distinguish between different investments, letting you know which projects are the cream of the crop.

As with most things, it has some disadvantages, but they’re not plentiful. The main drawback of this financial formula is that it relies heavily on forecasts and assumptions. Because of this approach, a few relatively minor incorrect assumptions can lead one to believe that an investment will be more profitable than it is.

However, compared to more rigid standards like return on investment and rate of return, it has the advantage of flexibility. Considering inflation and other factors helps you see the value of returns practically.

Most financial analysts will agree that net present value is an invaluable tool if you plan on making investments. As long as you use this tool wisely, it can only benefit your company.